DISCLAIMER: DO NOT USE MY ARTICLES AS FINANCIAL ADVICE. CONSULT A PROFESSIONAL AND PERFORM ANY ACTIONS AT YOUR OWN RISK

Gold, Silver and Platinum are some of the most popular precious metals currently available for investors. They’re often seen as the “safe haven” for investors who want protection from inflation and diversification for their portfolio. Most prefer gold while always sharing the common, yet only partially true belief that gold – being gold, will perform best, even through market volatility.

Uses of Precious Metals

Table of Contents

While Silver may be commonly known as the “poor man’s gold,” it has indeed surpassed gold in growth. Silver has quite many uses, such as electronics and engineering, solar technologies and soldering, cars, and silverware, while gold is used for jewellery, medals and showpieces, but mainly as an investment by central banks.

As the demand for electronics, cars and solar energy goes up, the need for silver will also go up, while gold continues to remain in its prime – as a precious metal commodity owned by banks and people across the world. Platinum, on the other hand, is used in the electronics industry, as a precious metal in jewellery, and as a catalyst. With demand affecting prices, silver and gold may benefit in the long run here, with more and more people purchasing them as insurance against inflation/recession and financial crisis, while platinum may grow more slowly.

Costs for New Investors

Silver is also cheaper than Gold by a mile. As of 2nd November 2024, Gold was approximately $87 per gram [2], while Silver was roughly $1 per gram [1], and Platinum was about $32 per gram [3], making gold 87 times more expensive than Silver and Platinum 32 times more expensive than Silver. Silver, being cheaper but having a similar demand, can be a good way for new investors to get into the precious metals space without investing too much capital at the beginning.

Long-Term Returns

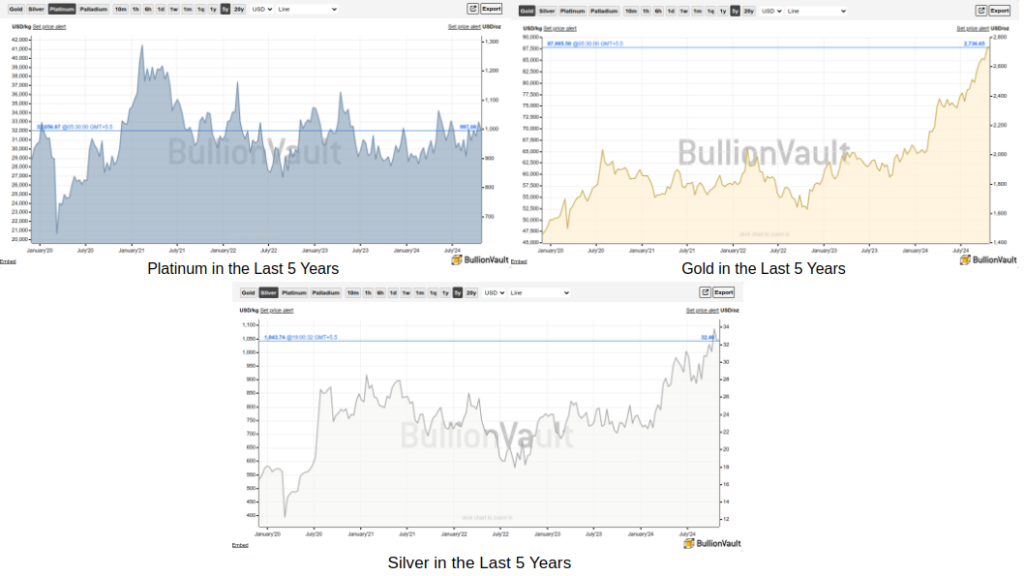

Over the long term, from 20th October 2023 to 24th October 2024, Gold went from about $64.4 per gram to around $87.9 per gram, marking a 36% increase [2]. Silver went from roughly $0.74 per gram to approximately $1.04 per gram, marking around a 41% increase[1]. Platinum went from $29.1 to $32 in the same period, making about a 9% increase [3]. This marks the turning point, as the demand for Silver now begins to surpass gold and platinum.

Survival through Crisis

Though Gold often shows less volatility, both metals remain sound during financial crises and inflation, with Gold only being minutely better than silver during inflation. During recessions, both show an increase in price, with demand rising. For example, during the recession of 1973 to 1975, gold surged by 87%, and in the Covid-19 recession from January to August 2020, gold rose by 28% [4], while silver went from $0.582 to $0.773 [1], marking a 32% increase in the recession. Platinum, though, was more volatile, reaching a low of $20 per gram and then going to $30.8 – almost back to its original price before the recession (approximately $32) [3]. Here, Silver is shown as one of the best performers in crises.

Investing in Precious Metals

To invest in both, you can buy them in the forms of coins/bars/jewellery, but it might be more beneficial to purchase coins and bars over jewellery, to avoid making charges and more, which will set you back on profits and make a bad investment. Moreover, you can also buy ETFs (Exchange-Traded funds), which have no making charge at all (not even the small making charge put on coins and bars), and roughly mirror the price of these precious metals, making it a better investment, and you wouldn’t even have to worry about keeping these metals safe or them tarnishing too!

In Conclusion

Overall, I see a turning point in the Bullion Battle, with Silver gaining an edge over Gold and Platinum and becoming a fierce competitor for Gold with demand rising, and hopefully continue giving better returns than it in the long term!

Citations

- “Silver Spot Price Chart” – https://www.bullionvault.com/silver-price-chart.do

- “Gold Spot Price Chart” – https://www.bullionvault.com/gold-price-chart.do

- “Platinum Spot Price Chart” –https://www.bullionvault.com/platinum-price-chart.do

- “Why gold is a key asset in recession-proof portfolios” – https://www.cbsnews.com/news/why-gold-is-a-key-asset-in-recession-proof-portfolios/ (From “History repeats itself” subheading)

[Image Credit – Freepik and Bullionvault]

Leave a Reply